|

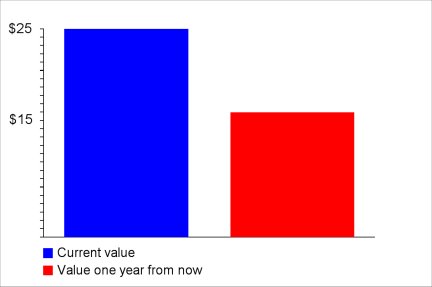

<<< Continued from previous page Okay, let's look at an example of how this might play out. Suppose you purchase 1,000 books today for $.50 each - a $500 investment. Suppose also that these books have a current market value of $5 each. Reasonable, yes? $500 for a $5,000 inventory? But is it a $5,000 inventory? Let's say that, in the first three months - and I'm being generous here, especially if you're an inexperienced seller - you sell 100 of these books at $5 each, the second three months another 100 at $4 each (a necessary price reduction to stay competitive as values fall), the third three months another 100 at $3 each, and the final three months another 100 at $2 each. Your earnings for the year are $500 + $400 + $300 + $200 = $1400. Minus your cost of acquisition, you're left with $1,400 - $500 = $900 (and let's leave costs of doing business out of it for now). The remaining 500 books are now essentially worthless, so your initial investment of $500 actually purchased only 500 books at an average cost of $1.00 each - double what you thought you were purchasing them for - and you have no remaining inventory from this purchase to carry forward into the next year. In other words, as far as this group of books is concerned, you're done - except for that trip to your local Goodwill to unload them. Now, let's take that $900 and subtract the additional costs of doing business. Or start to. I want to keep this as simple as possible because it's the broader point I'm interested in, but it wouldn't be far-fetched to assume that, on average, at least $1 was spent for each of those 1,000 books in your inventory on listing fees and sales commissions alone - in other words, we can take $1,000 right off the top. Only there isn't enough top to take it off of because you're already $100 in the hole and you haven't even begun to factor in the many other expenses! And don't forget that, had you not lowered prices during the course of the year, your outcome would've been significantly worse. Do these numbers change for full-time booksellers who maintain much larger inventories and have more experience selecting inventory and marketing it? Fulfilling sales? Sure they do, but even if you manage to push your business into the black and make a tolerable income, as long as your ASP remains in $5 territory, all or most of your time will be consumed doing nothing but scouting, listing books, and fulfilling sales. Which brings me to the second point you should never lose sight of: Time is your most precious resource, and if you use all of it to buy and sell books, I wouldn't bet on your business surviving. (More about this in forthcoming articles.) Depressed? Good! Now look at this graph:

Ah, the $25 book. Feel better? Not nearly as vulnerable to downward price pressure, so is this where you need to be? Next week I'll do a similar analysis on this class of books.

Want to read more articles by

< to previous article

Questions or comments?

| Forum

| Store

| Publications

| BookLinks

| BookSearch

| BookTopics

| Archives

| Advertise

| AboutUs

| ContactUs

| Search Site

| Site Map

| Google Site Map

Store - Specials

| BookHunt

| BookShelf

| Gold Edition & BookThink's Quarterly Market Report

| DomainsForSale

| BookThinker newsletter - free

Copyright 2003-2011 by BookThink LLC

|

|

|