Bookselling in the 21st Century

Part XV: Visualizing What You Need to Do to Make Bookselling Work: $25 Booksby Craig Stark #143 26 April 2010

|

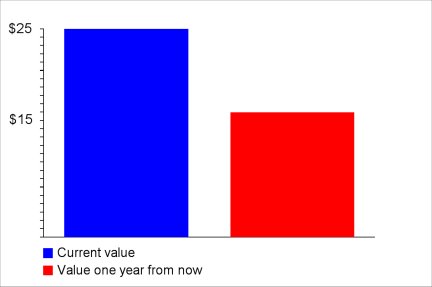

Last time I left you with the following graph:

Before I get into a discussion about selling books in this price range, let's look at just a few of the forces that exert a downward pressure on prices. Here are some specific examples that come to mind:

1. Most of us know first hand that textbooks can plunge precipitously when a new edition supplants a previous one. What was a $50 book one day may struggle at $5 thereafter. It's also true that, even if an edition remains current into the following semester, prices drop some as classes get under way - and sales may slow considerably. Exacerbating this, of course, is the trend toward digitization.

2. Sellers who participate in Amazon's ProMerchant program have the ability to create new catalog entries where none are in place, an

especially useful privilege if, like me, you seek out less common titles to build your inventory - well, sometimes we think we have something uncommon because there are few or no

comps online at the time we create the entry. But a few months pass, and whoa, now there are a half dozen copies competing with ours because non-ProMerchant sellers (who have previously

been unable to list this book) have seen your book priced ambitiously at $50 and are only too willing to accept $40, $30, and so on until, say, the lowest-price copy settles at $5, and

suddenly you look like a seller who's living in dream land. Of course, the reality is that the book probably isn't even worth $5 because it has little or no content value and simply

exhibited an early false scarcity / potential value because it was printed in limited numbers - which is to say, if it had had any value, copies would've been selling and

a higher price would've been supported. In this context, one of the more important instincts you can develop as a bookseller is what we could call an evaluative nose, whatever it

is that enables you to quickly get a sense of whether or not a book has content value.

3. If you buy or sell on Abebooks, you've seen this phenomenon in spades - the POD effect. A few years back, if you listed an uncommon but desirable book, you could expect to both command a good price and enjoy visibility on the first page of returned results. Often this is no longer the case - on both counts. Why? Because lower-priced Print-On-Demand "books" often glut the first and second and sometimes later pages, and in many cases these aren't books at all but simply veiled offers to print a book (freely available in a digitized format online) after you purchase it. And, of course, copies in CD format exert a similar downward pressure on prices for print copies.

4. As a bookseller who specializes to some extent in signed hypermoderns, I can tell you that, if this is an area that interests you, it will help your cause immensely if you can both develop that evaluative nose I mentioned and also take merciless advantage of what is likely to be a small window of opportunity. By the latter I mean that your best chance to sell a signed book for significant profit is immediately after a debut signing (or very early into a signing tour) - or to choose books by authors who do limited or no touring, have written a debut novel that you sense might be a sleeper, have just recently fallen into the public spotlight, or are at least moderately collectible but sadly are about to buy the farm. (And a lot of this information is available to those of us who are willing to dig.) If this window closes, selling becomes more problematic, and usually aggressive price reduction is in order.

5.This phenomenon isn't talked about much, but a bookseller who lists uncommon inventory on multiple venues, especially if those venues issue regular Google feeds, runs at least some risk of creating a false impression that multiple copies are available - i.e., an impression that an uncommon book is common. Throw a few more booksellers who are listing the same books into the mix, and it may look as though the market is awash in copies. This also can exert a downward pressure on prices to the extent that it discourages buyers from pulling the trigger on what is seemingly a common book.

I could include many more examples, but these at least underscore the complexities involved. Any discussion involving how far and how fast prices will plunge in a given price-class of books, whether that class is $5, $25 or higher, is necessarily iffy when applied to specific titles. My graphs, therefore, are not intended to be a hard and fast indication of how things are going to play out for you in a year's time but rather more or less plausible props (based on my own experience) to illustrate a broader point - namely, that price stability increases as booksellers raise their ASPs.

Okay, let's do the same pricing analysis on $25 books that we did last week on $5 books. Again, suppose you purchase 1,000 books today for $.50 each - a $500 investment. Suppose also that these books have a current market value of $25 each, leaving us a starting inventory of $25,000.

Again, let's say that, in the first three months, you sell 100 of these books at $25 each, the second three months another 100 at $21.67 each (a necessary price reduction to stay competitive as values fall), the third three months another 100 at $18.33 each, and the final three months another 100 at $15 each. Your earnings for the year are $2,500 + $2,167 + $1,833 + $1,500 = $8,000. Minus your cost of acquisition, you're left with $8,000 - $500 = $7,500. The remaining 500 books, on average, are now going to continue to decline in value but as yet are far from worthless, unlike the $5 books in our previous discussion. Since your labor is already built into these, the cost of continuing to list them is less punitive than it would be if you were listing $15 books anew.

Now, if we take the remaining $7,500, and subtract the costs of selling them and reinvesting in new inventory, it's not unreasonable to assume a net of $5,000 or $6,000. Make 10 similar buys in a year's time - or do what most of us do and buy continuously in smaller lots - and you'll realize an adequate income. Continue to do this the following year, and things should improve because you'll be selling some of the $15 and under books that didn't sell the first year they were listed, though not at the same velocity.

Is this a sustainable business model? Yes, as long as you aggressively pursue the acquisition of inventory and develop reasonably efficient listing, fulfillment, etc., methods. If there's a downside, it's that the realities of this business - given in particular the nature of your competition, even if it has dropped off some lately - are that you won't have much, if any, energy/time left to take your business to the next level. You'll be working too hard doing the busy work of bookselling. If you acquire business-enhancing knowledge at all, it will more likely be by a sort of osmosis that occurs by way of noticing, for example, which books you have luck with and which you don't than it will be by dedication application.

Why is this important? Because if you want to increase your income beyond adequate, you'll almost certainly need to raise your ASPs even further, say, to $50, and frankly, this is where the demands placed on you change their spots. Most of you will not be able to get to this level without acquiring additional bookselling-specific knowledge via dedicated application.

More about this next time, when I look at $50 books.

Copyright 2003-2011 by BookThink LLC